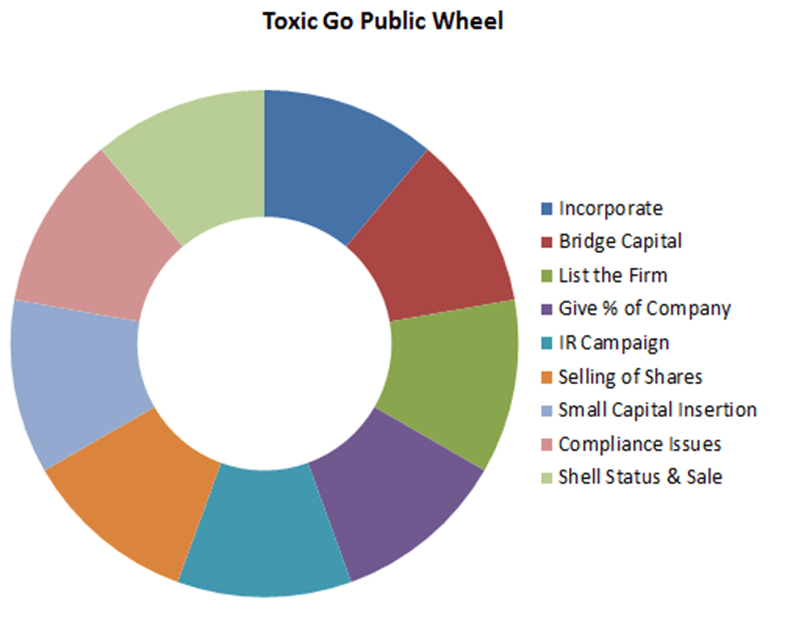

Toxic Cycle of Listing on a Stock Exchange Listings with Bridge Capital Financers Disguised as Listing Firms

Within the past 18 months the number of foreign listings from firms in the US listing on the Frankfurt Stock Exchange, firms from Canada Listing on the Frankfurt Stock Exchange, Firms from Australia listing on the Frankfurt Stock Exchange have all run into the typical toxic wheel of going public with the wrong group of going public professionals. Whether they were firms in Australia, Canada, the US, or UK who claimed to list your firm, the pro’s behind the listing followed the following principles:

- They incorporated your company without considering your future structure and necessary resolutions

- They offered some kind of bridge capital that encumbers your assets and ability to raise funds

- They would then list the firm, likely taking a variety of fees for what they would call legal, accounting, or consulting services

- They offered IR services over 3, 6, and 12 month periods with the idea that they themselves would work with your firm, hold shares, and only sell shares with the market as a service (relatively complicated to define whether this is legal)

- They take a percentage of the business as well (roughly 5% or more)

- They run the market and sell their shares into the market as a form of making the market, with their shares in account, and your shares in account, they somehow end up selling the majority of their shares during this process

- A capital insertion into your firm comes at a fraction of what is expected in going public

- Your firm has difficulty complying with FSE Listings regulations and costs of market making

- Your firm becomes a shell, of which the group who took you public will convince you your firm is just not marketable and ask you to sell the shell for you and go private

10. The shell gets sold for peanuts or given up in a merger transaction, you are in a private firm now with your assets and some liabilities

There are several firms that sell this toxic cycle of listing firms, we know about this process because we have been business owners like yourself before. We have experienced firsthand what a dishonest or misleading public listings or merger law firm can do to your firm. Our associates and ourselves built a process for going public which is affordable, sustainable, builds real companies and value.

Firstly, merger law for vending a company into an existing shell company is relatively straight forward. The merger law however doesn’t help if you overlook the following, bridge capital and going public professionals within the field do not tell the underlying costs of bridge capital to get a shell company:

- The shell company they pass on to you requires due diligence based on potential debts and liabilities they may have (indemnification is not enough)

- The debt left on the company is generally much higher than the regular fee of listing

- The size of your company that is kept by the bridge capital group is often 5-10% of your company, we will outline how this can destroy your firm

- In addition to shell company bridge capital programs, there are listings from scratch bridge capital programs, that look like this:

- They claim to pay all the expenses of going public on the Frankfurt Stock Exchange

- They claim to run a 3 month promotional campaign

- They take 5-10% of your company depending on how hard you negotiate

From a laymen’s eyes, this looks like a pretty good deal for listing a company. However, here is the flaws in these programs

- New companies start of relatively illiquid, even 50,000 shares of a company could cause a drop in stock price

- Where there is a 3 month campaign for IR, the bridge financer can dump their stock (even if they say they will not) using your companies good name, causing in essence a pump and dump using your firms name. (Possibly ruining your reputation.) They will always sell first, convincing you they are entitled because they listed your firm. They will never see the same value as you do in the percentage of your company that they hold.

- They never relinquish full control, often these Bridge Capital companies or fse listings now firms that are unethical will have clauses, debts, caveats, and defaults that hold the company and management hostage (often until they have blown-out their shares.)

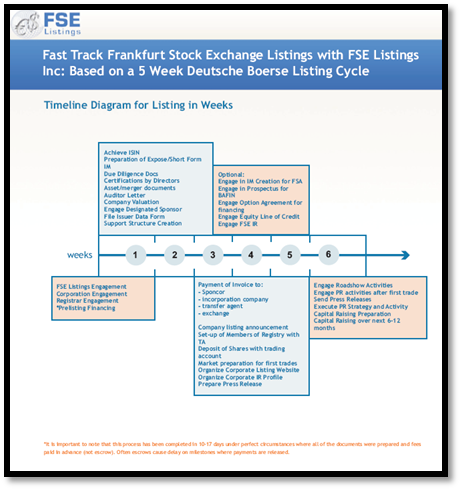

If you want to list your firm in a non-toxic fashion, you should read about the FSE Listings Inc Go Public Process for Success:

Please review the new Frankfurt Stock Exchange Listings packages for people looking to go public on the Frankfurt Stock Exchange the right way.